Medicare Workshop

Where Your Journey Begins

Insurance Carriers Will Be Sending Out a Letter to You of the Annual Notice of Changes

Please Do Not Ignore This Letter

Read It Thoroughly

Recognize the Changes That Are Going to Affect You Next Year

There Will Be Some Negative and Positive Changes in the new year.

Meet With Your Trusted Broker

If You Do Not Have an Insurance Broker, Please Call Me.

Joe Louie Carbajal, (480) 332-7186 TTY: 711

Learn More About Our Medicare Workshops

Attend a Free Dine & Learn Medicare 101 Workshop. See the dates and times of the upcoming workshops

What We Will Cover

*Changes to Part D & Impacts

Understanding the Basics

4 Parts of Medicare

Part A

Hospital Insurance

Part B

Medical Insurance

Part C

Medicare Advantage Plans

Part D

Prescription Drug Plans

Eligibility Requirements

Who is Eligible for Medicare?

Worked in the U.S. for at least 10 years with 40 work credits.

Medicare ABC & Ds

Part A: Hospital

Hospital Stays

Skilled Nursing Facility (SNF) --Not Long-Term Care

In-Patient Surgery

Hospice

Part B: Medical

Some Benefits Include:

Doctor Visits

Outpatient Services

Diagnostic Labs & Tests

Radiology

Emergency Room

Urgent Care

Ambulance

Durable Medical Equipment

Part C: Medicare Advantage

HMO, PPO, PFFS, MSA

HMO and PPO Plans Are the Most Popular

Keep Your Original Medicare Card, but Your Primary Insurance is Your Advantage Health Plan.

Most MAPD (Part C) Plans Include Prescription Drug Coverage

Most Will Include Extra Benefits

Medicare Pays Private Health Plans to Manage Care

Lock-in and Enrollment Periods

Part D: Prescription Drugs

Prescription Drugs: Generic to Brand Name

Part D: Coverage Phases

Inflation Reduction Act

The lower-cost prescription drug law states your annual out-of-pocket costs will be capped at $2000 for people with Medicare Part D in 2025.

--US Dept. of Health and Human Services

Eliminates:

Initial Coverage

Coverage Gap (Aka Donut Hole)

Catastrophic Coverage

What Original Medicare Does Not Cover

Most Dental Care (Including Dentures)

Routine Eye Exams

Routine Foot Care

Orthopedic Shoes

Hearing Aids and Exams for Fitting Them

Long-term Care (Also Called Custodial Care)

Cosmetic Surgery

Acupuncture

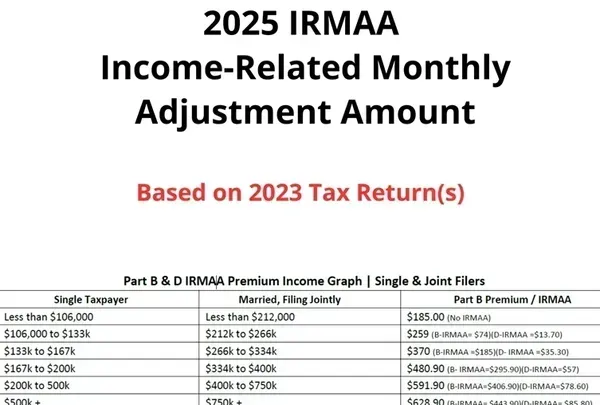

What is IRMAA, and How Does It Affect My Medicare?

IRMAA: Income-Related Monthly Adjustment Amounts

Medicare Supplements

Plan Types

Fills the Gaps in Original Medicare (the 20%)

Standardized Plans A — N With All Carriers (Only Difference is Cost)

Plan G is the Most Comprehensive (Similar to Plan F)

Plan N is the Most Affordable and Has Some Copays.

Medicare Supplements Do Not Include a Drug Plan

Qualifications

Must Have Medicare Parts A & B

Must Apply in Your Resident State

No Medical Underwriting Within 6 Months of Your Part B Effective Date

Must Qualify Medically if Not in Open Enrollment or Have a Guaranteed Issue Right

May Change Plans Anytime of the Year

Pros

Visit Any Doctor in the U.S. Who Accepts Original Medicare

No Referrals Required

Auto Claims Filing—No Paperwork or Extra Billing

Predictable Healthcare Costs

Cons

Premium Costs for Part B and Part D Can Be Difficult to Afford or Maintain.

Annual Rates of Increase

Most Do Not Include Extra Benefits

When Can You Buy a Medicare Supplement?

At age 65 or anytime during the year, shopping for rates may save you 15 – 30% if you qualify.

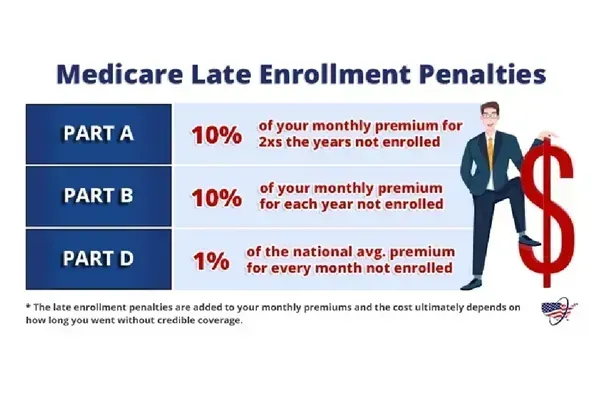

How to Enroll

Get Started With Social Security!

If you collect Soc. Security (prior to age 65):

No action is needed

At least 3 months before you turn 65, you automatically get Part A and B of your Medicare card sent in the mail.

If you do not collect Soc. Security (or wait after age 65) & want Medicare Part A & B:

Contact SOC Security at

ssa.gov/medicare, call

(800) 772-1213 or go to the local SOC. Security office. Provide a payment method for Part B.

If you plan to keep working (past age 65):

No action needed! But…

You CAN apply for Part A benefits (or WAIT) &

Delay Part B (as long as you have creditable insurance coverage)

3 months before you retire, fill out form CMS-L564 with HR and submit to Soc Security with Part B application.

Create Your SSA Account

Make an account on https://www.ssa.gov/myaccount

To monitor your Soc Security benefits and apply for Medicare!

Your Official Medicare Guide

The 'Medicare & You' Handbook is Your Official Guide to Medicare.

Medicare Households Receive an Updated Printed Handbook in Late Sep

You Can Also Download a Copy Anytime, or Access It Electronically

Keep Your Handbook as a Reference. It Has Important Information About:

Medicare Benefits, Costs, Rights, and Protections.

Health and Drug Plans.

Answers to Common Questions.

Inflation Reduction Act

Pros

Donut Hole Eliminated

Tier 3, 4, 5 May Decrease

Capped Monthly Amount

Cons

Tier 1 & 2 Most Likely Will Increase

Part D Premiums Will Increase

Part B Premiums May Also Increase

Group Plans Will Most Likely No Longer Be Considered

Creditable Coverage Due to the Cap Put on Part D Coverage Amount $2,000

What Our Partnership Entails

Review all your doctors & medications

Recommendations based on your individual needs. (Travel, access to providers, low copays/premiums, dental/vision, etc.)

No cost for my services, I'm compensated by the insurance carriers.

- All compensation is regulated by CMS, and is the same with every MAPD carrier.

Support throughout the year

Complete annual reviews and/or when your needs change

JOE LOUIE CARBAJAL

(480) 332-7186

TTY: 711

Counter Measures for Medical Expenses

Hospital Indemnity Plans

Cancer Plans

Short-Term Living at Home Plans

Critical Illness Plans.

Next Step: Permission to Contact Form

Drop Us a Line!

Contact Us

We will get back to you as soon as possible.

Please try again later.

For a No-Cost Consultation for Your Specific Needs!

Request an Insurance Consultation

Yes, I want more information!

Medicare Advantage

Medicare Supplement

Part D / Prescription Drug

Low Income Subsidy / Extra Help

Dental / Vision

Hospital Indemnity

Life / Final Expense

401(K) Roll-over

By providing my phone number, I agree to have Joe Louie Carbajal an authorized licensed broker call, text, or e-mail me to provide more information. You are not required to complete this form but have chosen to do so at your discretion.

Protect What Matters Most

We do not offer every plan available in your area. Currently we represent 15 organizations. Organizations which offer 87 plans products in your area. Please contact Medicare.gov, 1-800-Medicare, or your local State Health Insurance Program (SHIP) to get information on all of your options.

Plans are insured or covered by a Medicare Advantage organization with a Medicare contract and/or a Medicare-approved Part D sponsor. Enrollment in the plan depends on the plan's contract renewal with Medicare.

Not affiliated with or endorsed by the government or Federal Medicare program.